Market Report: iGaming in Brazil

- Gaming in Brazil – Brief History

- Future Legislation and Bill 442/1991

- Provisional Measure Nr. 1182

- Suspension of the Unlicensed Operators

- Market Analysis

- iGaming Trends

- Elbet’s Market Position and Product Portfolio

- Elbet’s Partnerships with State-Owned Lotteries

- Key Trends Shaping Brazil’s Gambling Market

- Challenges for Market Entry and Expansion

- Conclusion: Seizing the Brazilian Market Opportunity

Gaming in Brazil – Brief History

The history of iGaming legislation and regulation in Brazil has been marked by periods of prohibition, slow legal evolution, and ongoing discussions about regulation. Here’s a brief overview:

Early Prohibition (1940s – 1990s)

- In 1946, Brazilian President Eurico Gaspar Dutra banned most forms of gambling, including casinos and jogo do bicho. Only state-run lotteries and horse racing remained legal.

- This prohibition created a long-standing black market for gambling activities in Brazil, with informal betting and underground gambling operations flourishing.

Bingo Legalization and Ban (1990s – 2000s)

- In the 1990s, bingo halls were legalized, and the activity became widely popular across the country. This period also saw the rise of informal online gambling.

- However, in 2004, the government banned bingo again after concerns about money laundering and corruption linked to the industry.

Emergence of Online Gambling (2000s)

- Despite the general ban on most forms of gambling, online gambling platforms began to operate in a legal grey area. Since there were no specific laws regulating online gambling, Brazilians could access international iGaming platforms, even though domestic operations remained illegal.

Increased Discussion on Regulation (2010s)

- In the 2010s, there was increasing political pressure to regulate the gambling industry, including online gambling (iGaming), due to its growing popularity.

- Several bills, including Bill 442/91, were introduced to legalize and regulate both land-based and online gambling, but progress was slow.

- Regulation on physical and virtual instant lotteries (Lotex) was created.

Key Legislative Milestones (2018 – Present)

- 2018: The federal government legalized sports betting (both online and offline) as part of the broader push for gambling regulation. The specifics of regulation were still being debated, but it was a significant step toward legalizing iGaming. National Law (No. 13-756) was passed, allowing international sports betting companies with valid licenses to operate legally in the country.

- 2020: Lottery was completely nationalised. Each state is given regulation of its lottery, and Caixa obtains a federal lottery license.

- 2022: Bill 442/91 passed the lower house of Congress, which includes provisions for the legalization and regulation of online gambling. This bill, however, is still awaiting final approval from the Senate and the president.

- Ongoing Regulation Efforts: Discussions continue, focusing on creating a regulatory framework for iGaming that includes licensing, taxation, and player protection.

Currently, iGaming remains largely unregulated domestically, though Brazilians participate heavily in international platforms. The legislative framework is in development, aiming to legalize and regulate the industry fully.

Future Legislation and Bill 442/1991

Brazilian Bill 442/1991 is a legislative proposal that seeks to regulate and legalize various forms of gambling in Brazil, including casinos, bingo, jogo do bicho (a traditional Brazilian numbers game), and online gambling. The bill has been in discussion for several decades and represents a significant shift in Brazil’s approach to gambling, which has historically been tightly restricted or outright banned, with only certain forms like lotteries being legal.

Key elements of the Bill 442/1991 are:

Legalization of Various Gambling Activities

- Casinos:

The bill proposes to allow the opening of casinos in resort complexes, integrated into large hotels or touristic destinations. It suggests a limit on the number of casinos per state, based on population size. - Bingo Halls:

Bingo, which was banned in Brazil in the early 2000s, would be legalized again, with the regulation of bingo halls and oversight to prevent money laundering and other illicit activities. - Jogo do Bicho:

This popular but currently illegal gambling game would be legalized and regulated. Jogo do bicho is a form of lottery-like betting that has existed informally in Brazil for over a century. - Online Gambling:

The bill also seeks to regulate online gambling, which is increasingly popular but largely unregulated in Brazil.

Regulatory Framework

The bill establishes a regulatory framework to oversee gambling operations, setting up licensing procedures and taxation schemes. It outlines strict rules for licensing, compliance, and enforcement to ensure that only authorized entities can operate gambling services.

Taxation and Revenue

The regulation of gambling is expected to generate significant revenue for Brazil. The bill proposes taxes on gambling activities, with funds directed toward public services like healthcare, education, and social programs. It also aims to address the black market by bringing informal gambling operations into the legal economy.

The Bill creates a new tax named “Cide-Jogos”. Such tax involves a fixed rate of 17% for games, and an inspection fee for issuing the license. The incidence of Individual Income Tax imposed on those who win prizes with amounts equal to or greater than BRL 10,000.00 will be of 20% on the net winnings, that is, on the prize minus the amount paid to bet or play. The operating entity will withho

ld the tax.

Combating Illegal Gambling and Money Laundering

A major concern of the bill is to combat illegal gambling and money laundering activities. The regulatory framework would include measures to prevent the use of gambling operations for criminal activities, with stringent monitoring and reporting requirements for operators.

Social Responsibility and Problem Gambling

Bill 442/91 emphasizes the need for programs to address problem gambling. It proposes creating support systems for individuals who develop gambling addictions, as well as educational campaigns to promote responsible gambling.

Status of the Bill

The bill was passed by the lower house of the Brazilian Congress in 2022 and has garnered both support and opposition. Supporters argue that legalizing gambling will boost the economy, create jobs, and curb illegal gambling operations. Opponents express concerns about potential social harm, such as gambling addiction and increased crime.

The bill still requires approval from the Brazilian Senate and presidential sanction before becoming law, but its passage in the lower house marks a significant step toward the potential legalization of gambling in Brazil.

Provisional Measure Nr. 1182

In an effort to regulate the sports betting market promptly, on May 11, 2023, the Brazilian Ministry of Finance submitted a Provisional Measure Nr. 1182 to President Lula da Silva for approval.

President Lula signed Provisional Measure No. 1182, implementing Law No. 13,756/2018 with several amendments.

The Provisional Measure stipulates that: “Fixed-odds lotteries will be granted, permitted, or authorized, for valuable consideration, by the Ministry of Finance and will operate exclusively in a competitive environment, without a cap on the number of licenses, and with the possibility of being marketed through any physical or virtual commercial distribution channels.”

This landmark decision marked a significant shift in Brazil’s gambling landscape. Key changes included:

- An increase in the gross gaming revenue (GGR) tax from 16% to 18%.

- A higher license fee, set to reach R$30 million (€4.95 million), up from the previous R$22.2 million.

- The creation of the National Secretariat for Games and Betting (SNJA) to regulate the sector.

- More stringent restrictions on marketing and advertising for gambling operators.

- Clear authorization for foreign operators to apply for licenses.

While the Brazilian legislature had 120 days to approve the Provisional Measure, the regulation took immediate effect as the law of the land.

The legalization of sports betting followed a lengthy journey, after the initial approval of Law No. 13,756/2018, when the government missed deadlines to finalize technical regulations.

President Lula, who is generally viewed as more favorable toward gambling than his predecessor Jair Bolsonaro, signed the measure amid rising public pressure, particularly after a series of match-fixing scandals in the country.

This pivotal moment represents the most significant step forward in regulating sports betting in Brazil since the 2018 law was first passed by Congress.

Suspension of the Unlicensed Operators

The Ministry of Finance said any operators that wish to continue operations must obtain permission from the Prize and Betting Secretariat (SPA).

At the time of writing of this analysis, 113 gaming operators have applied for authorisation nationwide, with the regulated market set to launch on 1 January. The government had previously said businesses would have until the end of December this year to adapt to the new rules. Government intended to keep the December adaption period for only businesses that have demonstrated they want to act within the law.

Currently there are two deadlines:

- By 30 September, active companies that have requested authorisation will need to inform the government which of their brands are operating and on what websites.

- From the 11 October, these websites and applications will be suspended and taken offline.

To enforce the ban, the Treasury said it intends to increase dialogue with the Ministry of Justice and Public Security, the Central Bank, and the National Telecommunications Agency.

Market Analysis

Population: 220 million

Language: Brazilian Portugese (official and most widely spoken language)

Largest Cities by Population:

• São Paulo, 12 million residents

• Rio de Janeiro, 6 million residents

• Brasília, 3 million residents

Approximately 87% of Brazilians live in metropolitan areas. This high rate of urbanization is driven by the concentration of economic activities, services, and opportunities in major cities like São Paulo, Rio de Janeiro, and Brasília.

Telecommunications

Brazil has fifth largest digital population worldwide, with 80% of Brazilians have daily access to the internet, which translates to around 180 million people. Internet penetration is expected to reach 98% of the population by 2029.

Fixed broadband internet subscriptions in Brazil have been increasing both in terms of quantity and velocity. In 2023, there were over 42.5 million fixed subscriptions with a transmission speed above 34 megabits per second (Mbps) in the South American country, up from approximately 2.91 million of such subscriptions recorded in 2016. Considering mobile phone subscriptions in Brazil, the fourth generation of wireless mobile telecommunications (known as 4G) has been expanding.

Average Brazilian spends 9.13 hours per day connected to the internet, out of which

• 5.19 hours on Mobile phones

• 3.54 hours on Computers and tablets

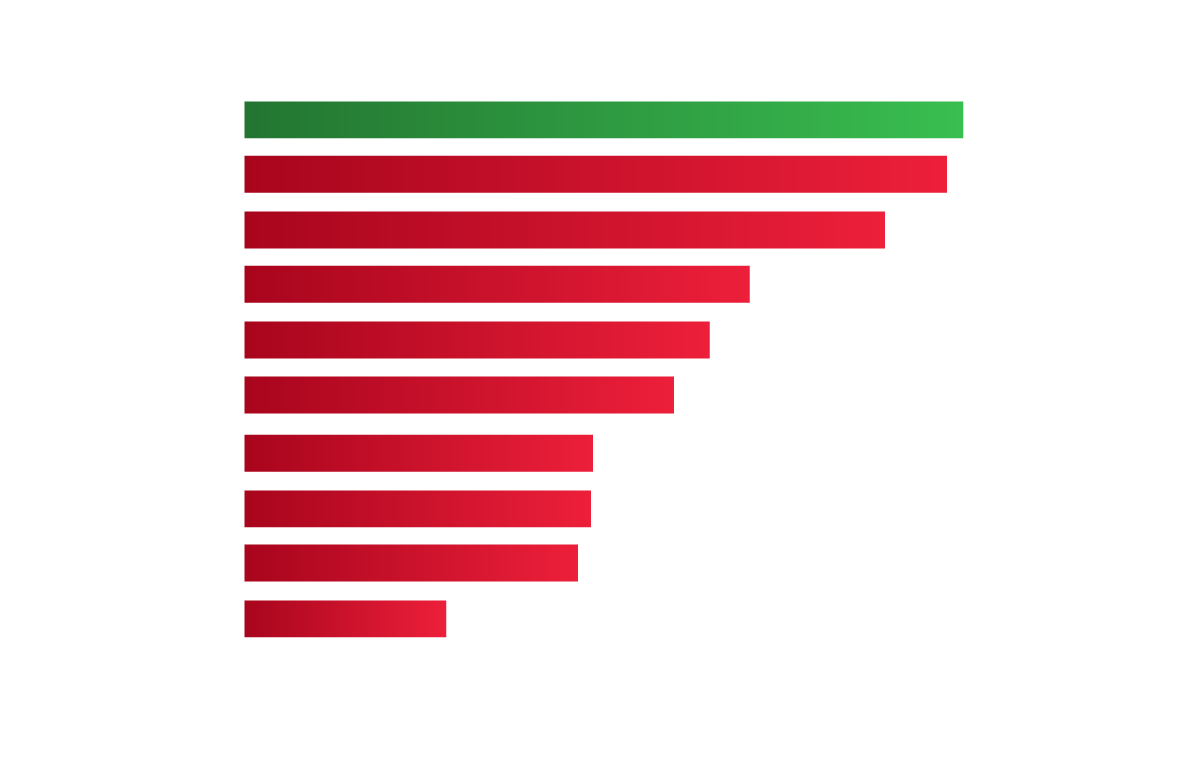

Internet usage penetration in Brazil in 2023, by age group:

According to a survey conducted in Brazil from March to July 2023, around 97 percent of respondents in social grade A accessed the internet. Meanwhile, only 69 percent of respondents from social grades D and E have used the web, representing 18 percentage points fewer than respondents from social grade C. Overall, it has been estimated that over 79 percent of the population of Brazil was online in 2023.

Most popular social media platforms in Brazil as of 3rd quarter 2023, by usage reach

Brazil has data centers operated by major cloud providers, including AWS (Amazon Web Services), Google Cloud, and Microsoft Azure.

Economy

The economy of Brazil is historically the largest in Latin America and the Southern Hemisphere in nominal terms. The Brazilian economy is the second largest in the Americas. It is an upper-middle income developing mixed economy. In 2024, according to International Monetary Fund (IMF), Brazil has the 8th largest gross domestic product (GDP) in the world and has the 8th largest purchasing power parity in the world with GDP of US$2.2 trillion (nominal).

Brazil with the 8th strongest economy in the world is expected to become one of the most valuable iGaming markets in the world.

Gambling Statistics

iGaming Trends

Our analysis has shown some additional key trends in the iGaming industry in Brazil, which are shaping its future and driving market growth:

Expansion of Sports Betting

Football-Centric Growth: Football remains the primary driver of the sports betting market in Brazil, with a large portion of wagers placed on local and international football leagues. As sports betting becomes more regulated, partnerships between football clubs, players, and iGaming companies are expected to increase.

Other Sports and Esports: While football dominates, there’s growing interest in betting on other sports like volleyball, basketball, and MMA. Esports betting is also gaining traction, particularly among younger generations, fueled by the popularity of competitive video gaming in Brazil.

Mobile Gambling Growth

The majority of iGaming in Brazil is shifting toward mobile platforms due to increasing smartphone penetration and affordable mobile data plans. Mobile-first platforms are becoming a focus for operators, making gambling more accessible to a broader population.

App Development: Many iGaming companies are developing mobile apps tailored to Brazilian consumers, offering features like live streaming, in-play betting, and intuitive interfaces, optimizing the user experience on mobile devices.

Live Casino and Online Casino Growth

As regulation evolves, the online casino sector is poised for significant growth. Games like online poker, live dealer games, and virtual slots are becoming more popular, especially as international operators invest in the market.

Live casinos that offer real-time games with live dealers (e.g., blackjack, roulette) are gaining traction. These platforms provide players with a more immersive experience that simulates the feel of land-based casinos, appealing to a diverse audience.

Cross-Platform Integration

As iGaming operators expand their offerings, there is a growing trend toward cross-platform integration, allowing players to move seamlessly between sports betting, online casino games, and poker on a single platform. This integration enhances user engagement and retention.

Localization and Customization

iGaming companies are increasingly localizing their platforms to suit Brazilian consumers, including providing Portuguese-language interfaces, local customer support, and payment methods like PIX (Brazil’s instant payment system), which is highly popular.

Custom promotions based on Brazilian holidays, cultural events, and football tournaments are used to attract and retain players, offering bonuses and incentives that resonate with the local market.

Cryptocurrency and Blockchain Adoption

Cryptocurrency payments are becoming more common in the iGaming sector, with several platforms allowing deposits and withdrawals in Bitcoin and other cryptocurrencies. This trend aligns with the increasing interest in crypto among Brazilians, particularly for its security and lower transaction fees.

Blockchain technology is also being explored for its potential in creating transparent, fair gaming environments, particularly in the areas of smart contracts and provably fair gaming mechanisms.

Regulatory Developments

With sports betting now legalized and more regulations expected for other forms of iGaming, Brazil’s regulatory landscape is becoming more attractive to both local and international operators. As Brazil formalizes its laws and creates regulatory bodies like the National Secretariat for Games and Betting (SNJA), the market is expected to see greater investment, increased competition, and enhanced player protection measures.

Taxation and Compliance: A clear and transparent tax structure will play a pivotal role in the market’s growth, as operators need to navigate Brazil’s taxation system (e.g., GGR tax, licensing fees) to operate effectively.

Increased Investment and Mergers

With the growing potential of Brazil’s iGaming market, there is an uptick in investment from international operators and venture capital firms, as well as interest in mergers and acquisitions (M&As). This consolidation is expected to create larger, more powerful gaming operators and enhance the overall market infrastructure.

Strategic Partnerships between Brazilian football clubs, media companies, and gaming operators are also likely to increase as iGaming becomes more mainstream and normalized in the sports and entertainment landscape.

Focus on Responsible Gambling

As the market grows, there is a rising emphasis on responsible gambling initiatives, with regulations mandating that operators implement tools to prevent problem gambling. Many platforms are introducing self-exclusion options, deposit limits, and awareness campaigns to address this.

Brazilian lawmakers are also looking at frameworks to ensure that the rapid growth of iGaming is accompanied by strong consumer protection measures, especially concerning vulnerable populations.

Increased Marketing and Sponsorship Deals

iGaming companies are increasingly using sports sponsorships as a major marketing tool. These include partnerships with popular Brazilian football clubs, league sponsorships, and endorsement deals with prominent athletes, expanding their brand visibility.

Celebrity endorsements and social media campaigns are becoming more common, as companies seek to leverage the influence of sports figures like Neymar, Ronaldo, and Ronaldinho to attract new players.

The future of iGaming in Brazil looks bright, driven by growing legalization, increased internet and smartphone penetration, and the passion for sports. The market is expected to see significant expansion across sports betting, online casinos, and emerging areas like esports and blockchain-based gaming. The combination of regulatory clarity and technological advances positions Brazil to become a leading iGaming market in Latin America.

Elbet’s Market Position and Product Portfolio

Elbet has a vast experience as a game content provider, working with more than 150 retail operators and 900 online casinos world-wide. Thousands of players from Brazi have already enjoyed our games, and we are eager to supply some of our flagship retail games to land-based operators as well.

Our most popular instant-win games are fully certified and ready for the Brazilian market:

Rocketman

Brasil

Market

Bingo 49

N. Macedonia

Market

GoldMines

Brasil

Market

Virtual games are designed for casual players, with a focus on the social aspect rather than gambling itself. Our virtuals are particularly popular in markets such as Africa and Eastern Europe, where players gather at sports betting shops to socialize and watch football matches, while also playing our games on the side.

Rocketman

Brasil

Market

Bingo 49

N. Macedonia

Market

GoldMines

Brasil

Market

Lucky Balls

Bosnia

Market

Elbet’s flagship retail products, Bingo 49 and Lucky Balls, have been particularly successful in engaging players in retail settings, offering a social experience that complements Brazil’s inclination towards community-based leisure activities.

In comparison, the spend per capita on Elbet games in Bosnia reached USD 153 in 2023, representing 2% of the GDP per capita for Republika Srpska. This level of engagement demonstrates the significant revenue potential for Elbet’s products when effectively localized and integrated into the market.

In comparison, the spend per capita on Elbet games in Bosnia reached USD 153 in 2023, representing 2% of the GDP per capita for Republika Srpska. This level of engagement demonstrates the significant revenue potential for Elbet’s products when effectively localized and integrated into the market.

Elbet’s Partnerships with State-Owned Lotteries

Moreover, Elbet’s extensive experience with state-owned lotteries in North Macedonia and Bosnia provides a strong foundation for potential partnerships with Brazilian state institutions. The performance of Elbet’s products in these markets has been remarkable, contributing to a 20% increase in lottery revenues in North Macedonia and a 25% increase in Bosnia. This additional revenue has been reinvested into national infrastructure and public services, illustrating the economic benefits of integrating Elbet’s products into state-operated systems.

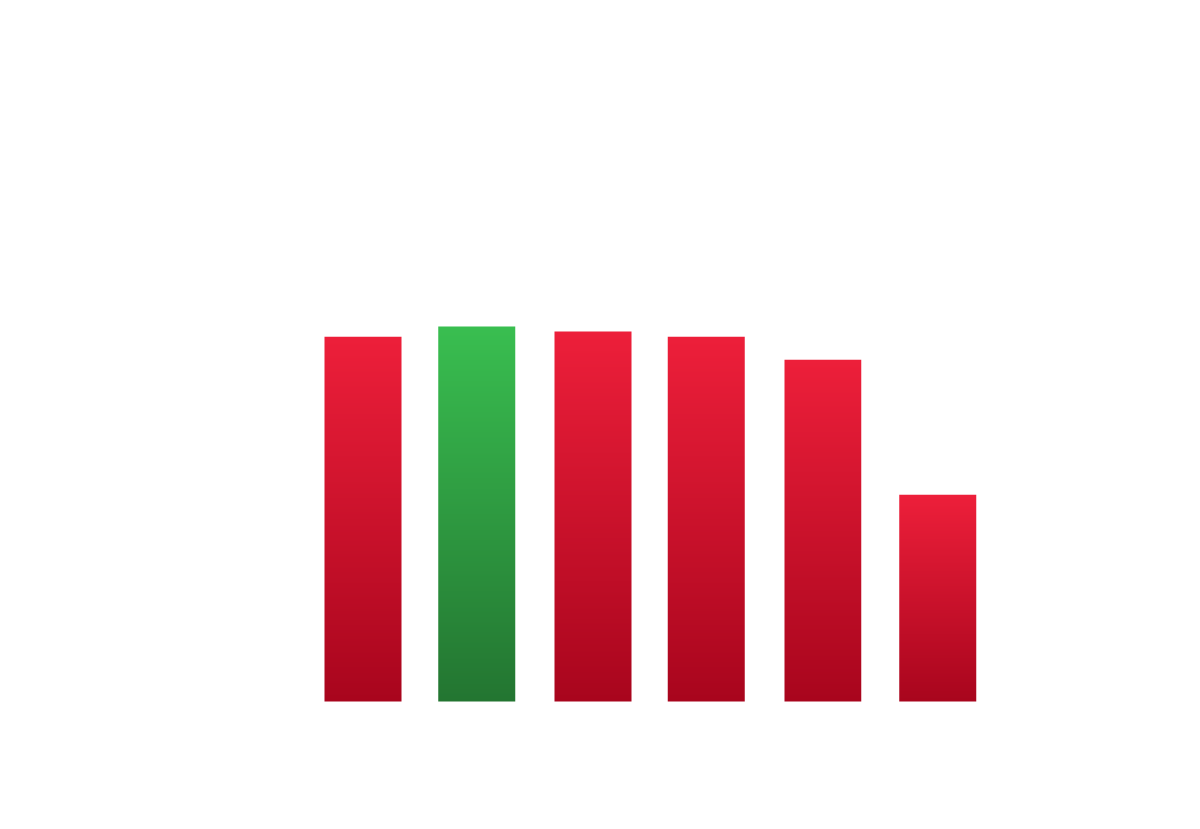

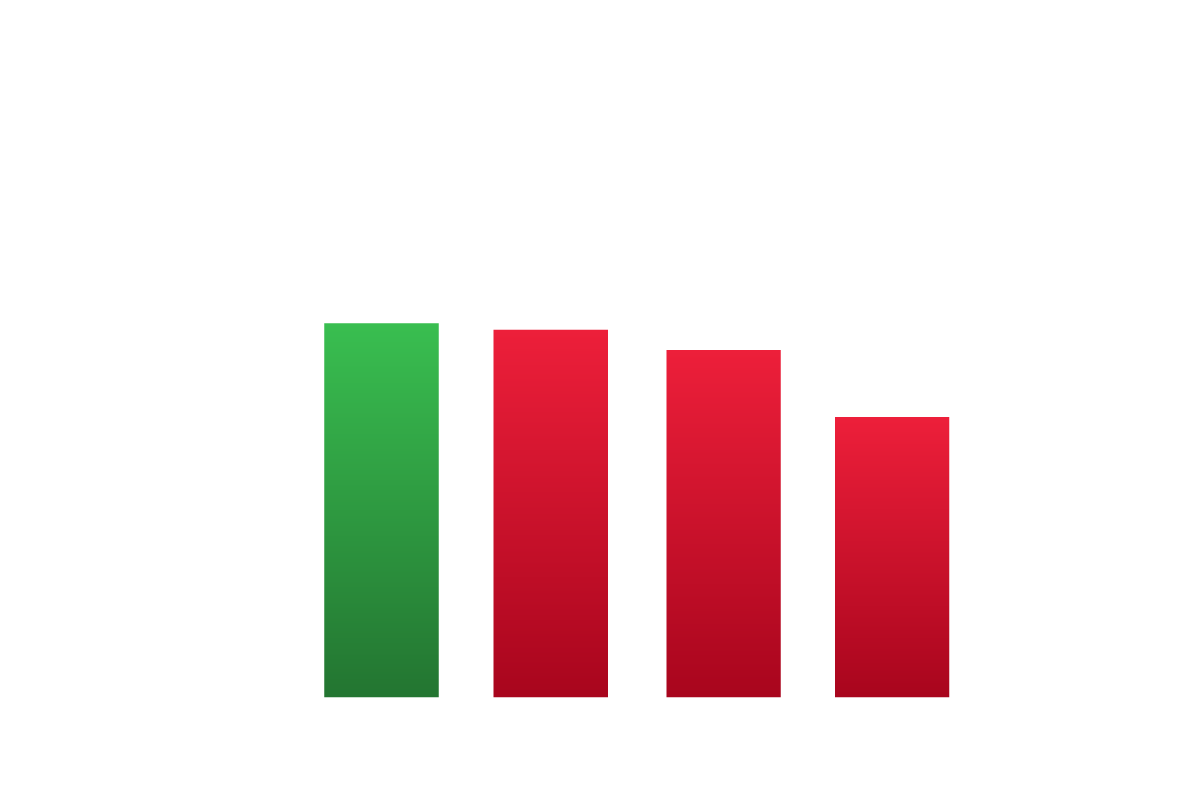

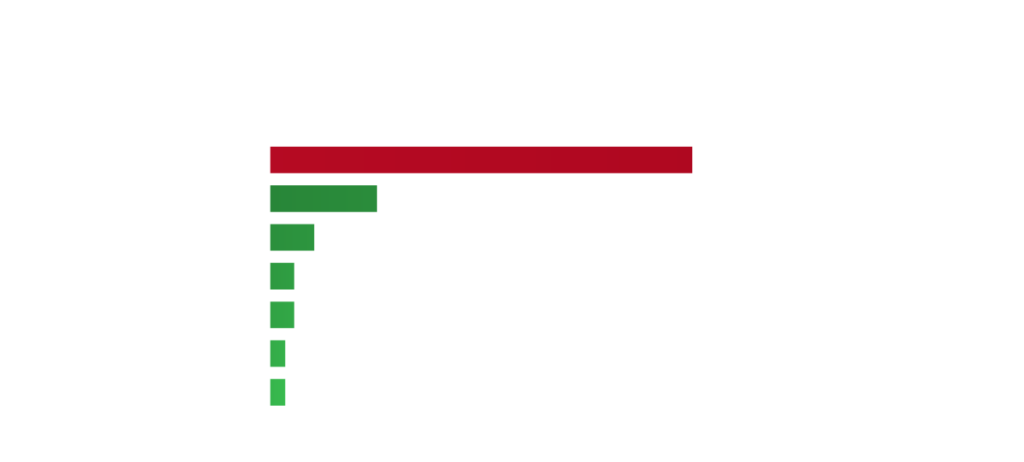

Lottery Revenue Growth in North Macedonia and Bosnia

Elbet’s flexible revenue-share model further aligns its interests with those of its partners, fostering a collaborative approach to maximizing returns. This proven model and operational expertise uniquely position Elbet to support Brazilian operators in scaling rapidly across both developing and developed segments of the market.

Key Trends Shaping Brazil’s Gambling Market

Key trends that will shape the evolution of Brazil’s gambling market include:

The expansion of online casinos and live dealer games.

The growth of mobile gambling, underpinned by rising smartphone usage and enhanced digital infrastructure.

The increasing adoption of cryptocurrencies and blockchain technology, with the cryptocurrency market in Brazil currently valued at $5.4 billion.

Elbet’s flexible revenue-share model further aligns its interests with those of its partners, fostering a collaborative approach to maximizing returns. This proven model and operational expertise uniquely position Elbet to support Brazilian operators in scaling rapidly across both developing and developed segments of the market.

Challenges for Market Entry and Expansion

While the opportunities for market entry and expansion are substantial, they are not without challenges.

Navigating the evolving regulatory landscape, managing high taxation—currently proposed at 18% of gross gaming revenue (GGR)

Combating illegal gambling and money laundering are critical issues that operators must address

Success in the Brazilian market will require a deep understanding of local consumer behavior, a portfolio of culturally relevant products, adherence to emerging regulations, and the ability to compete with entrenched grey market operators.

Conclusion: Seizing the Brazilian Market Opportunity

In conclusion, the Brazilian gambling market presents a multifaceted yet compelling opportunity for both local and international operators. As the regulatory framework continues to evolve and consumer demand for diverse gambling options increases, the potential for market expansion is significant. However, operators must carefully navigate the complex legal landscape, strategically position their offerings, and prioritize localization to fully capitalize on this burgeoning market.

Elbet, with its tailored product offerings, flexible business model, and proven experience in similar markets, stands ready to be a pivotal partner in the sustainable development of Brazil’s gambling industry.

Ready to start?

Drop us an email and our business development managers will help

taylor our product for our operation…

Contact Info

Lorem ipsum dolor sit amet consectetur. Magna amet sed mattis auctor eu mi. Interdum elit et ullamcorper diam venenatis. Arcu ac nisl facilisis nibh praesent

For sales inquiries reach us at:

For career opportunities reach us at:

For sales inquiries reach us at: